Materiality isn't a matrix. It's a governance tool.

Understanding what matters is only half the challenge. Strong governance determines who owns it

Most boards still don’t know what’s truly material to their organisation.

Not because they don’t care. Not because the data isn’t available. But because the materiality process is often seen as an ESG team exercise, disconnected from board reporting, risk management, and internal control design.

This week’s Playbook laid the groundwork for credible double materiality assessments. Today, I want to go a step further, into the operational heart of your business.

Here’s how materiality becomes a governance tool.

From assessment to action

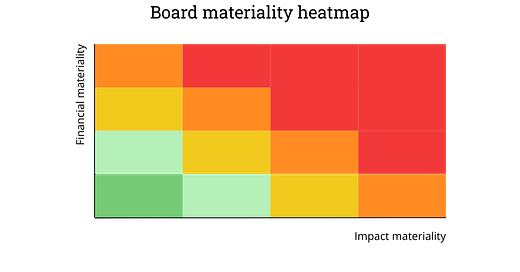

The vast majority of materiality outputs I see are used once, at the point of disclosure. Then they’re archived in a shared drive, buried in the back of an ESG report, or condensed into a heatmap that isn’t used by anyone.

A credible materiality process doesn’t end in a matrix. It flows into:

Risk registers, updated quarterly

Board and audit committee agendas

Policy review cycles

Control design and ownership

Strategic planning and capital allocation

If materiality identifies the sustainability risks and opportunities that matter most, then governance is how you make those visible, trackable, and decision-ready.

And yet, most boards still receive ESG updates in narrative form - detached from financial impact, with no defined KPIs, controls or audit coverage.

The three blockers to governance maturity

Materiality is still owned by sustainability, not the business

ESG teams run stakeholder engagement and draft the disclosures. But without cross-functional ownership from finance, legal, risk and operations, the outputs carry little weight in board discussions.Outputs aren’t linked to assurance or internal audit

If your organisation claims biodiversity, just transition or DEI is material—but there’s no control, KPI or audit plan in place—expect that to raise eyebrows with regulators and stakeholders.Board papers still treat ESG as narrative, not risk

Most ESG updates to the board are information-only. Few are integrated into decision-making packs or risk discussions. That has to change if double materiality is to be more than just a theoretical concept.

What good looks like

Board reporting includes a forward-looking materiality tracker

Audit committees are briefed annually on ESG controls maturity

KPIs and controls are assigned to issues identified as material - financially or by impact

Materiality reviews are triggered by regulatory, supply chain or reputational events - not just once every two years

Internal audit begins to scope ESG issues where controls are weak or governance gaps exist

None of this requires a full ESG overhaul. It requires asking:

What issues have we said are material - and how are we governing them?

What early CSRD reporters are doing well - and where they’re falling short

Based on recent CSRD disclosures I’ve reviewed, here are common themes emerging across sectors. These examples are anonymised but drawn from real patterns in the first wave of reporting:

A review of some of the first wave of CSRD disclosures offers a mixed picture.

A large European packaging group identified circularity as financially and impact-material. Their report included granular targets for packaging recyclability and linked these to board oversight, but omitted any control environment detail or internal audit scope.

A Scandinavian utility company linked climate risk to both their strategy and financial model and embedded materiality outputs into risk disclosures. However, their board-level governance section contained boilerplate language with little evidence of ESG-specific ownership.

A global food producer produced one of the most visually polished materiality matrices, but included over 25 "material" topics with no prioritisation, control assignment or board linkage. This raises questions about whether any of those topics truly influence decisions.

The common theme? Even when double materiality is well scoped and explained, governance maturity lags behind.

Materiality without ownership and follow-through is just… marketing.

What to do next

Start here:

Download the Double Materiality Playbook and revisit your last materiality assessment

Identify 3 issues flagged as material. Ask:

Do we have a board owner?

Are there controls or KPIs linked to it?

Has it been discussed in the last board or risk meeting?

If the answer is no, start the conversation internally. Not with a slide deck, but with a challenge:

“We’ve called this material. Are we treating it that way?”

Materiality is not a tick-box. It is the bridge between stakeholder expectations, risk exposure and strategic decision-making.

If your team wants to build that bridge, I’m always up for a conversation. Reply to this email or book a Teams call.